Online Gaming: Clarity on TDS regulations

TAXATION OF WINNINGS FROM ONLINE GAMING PLATFORMS IN INDIA

Content by: Pallav Narang & Neha Nayak

The online gaming industry in India has witnessed a tremendous surge in popularity and has now become a thriving sector with significant opportunities. Many individuals engage in activities such as fantasy leagues, card games, and online challenges, involving real money transactions and is provided legal sanction in India by the Honorable Supreme Court.

While the revenues of the platforms, and the users, were increasing manifold, to address the taxation aspect of such income generated from online gaming, the Union Budget 2023 introduced sections 194BA and 115BBJ into the Income Tax Act, effective from July 1, 2023.

Section 194BA entails the provision for Tax Deducted at Source (TDS) on net winnings from online games. Meanwhile, section 115BBJ specifies that income tax must be paid on the “net winnings” from online games at a flat rate of 30%, along with applicable cess and surcharge. It is important to note that the basic exemption limit does not apply to winnings from online games.

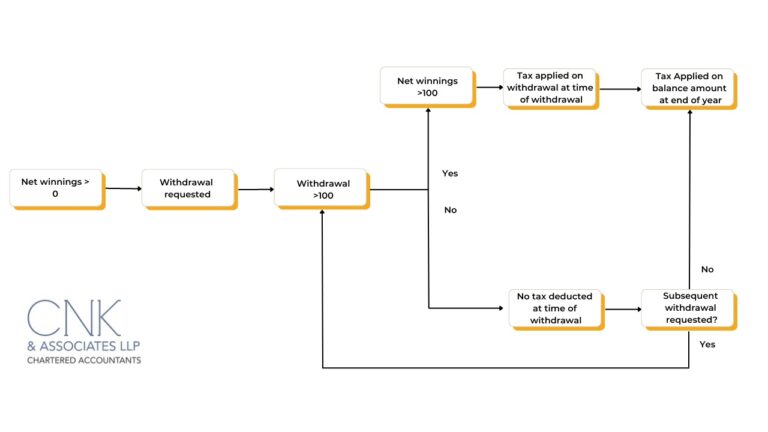

As per section 194BA a 30% TDS deduction will be made at the time of withdrawal as well as at the end of the financial year, regardless of any threshold limit. In case of withdrawals made during the financial year, tax will be withheld on the net winnings included in the withdrawal, while the remaining amount will be subject to tax at the end of the fiscal year.

This revised provision regarding TDS deduction will be effective from July 1, 2023. Until June 2023, a TDS deduction limit of Rs. 10,000/- will apply as per section 194B. However, starting from July 1, 2023, there will be no threshold limit for the application of TDS. Consequently, any transaction carried out on an online gaming platform will attract TDS at a rate of 30% (plus applicable cess and surcharge).

From a taxation standpoint, the income derived from online gaming is considered as “Income from Other Sources,” and both TDS and income tax should be computed based on the net winnings.

Circular No. 5 of 2023, issued by the Central Board of Direct Taxes (CBDT) on May 22, 2023, provides comprehensive guidelines for the implementation of section 194BA of the Income-tax Act, 1961. This circular offers clarity on various aspects, including the computation of net winnings, treatment of multiple user accounts, taxation of deposits, treatment of bonuses and incentives, withdrawal criteria, relaxation for insignificant withdrawals, taxation of winnings in kind, valuation of winnings, and penal consequences. The circular emphasizes the responsibility of deductors to adhere to tax deduction requirements and provides a timeline for depositing any shortfalls in tax deductions.

In summary, the circular provides the following clarifications regarding the applicability of section 194BA – TDS on winnings from online games, effective from April 1, 2023:

- If a user has multiple wallets, each wallet will be considered as a separate user account for tax purposes. Deposits and withdrawals from each account will be treated accordingly.

- The formula to compute net winnings is: A – (B + C), where A represents the amount withdrawn, B represents the aggregate of non-taxable deposits made by the user until the time of withdrawal, and C represents the opening balance at the beginning of the financial year.

- If a deductor or operator operates multiple platforms under a single Tax Deduction and Collection Account Number (TAN), they have the option to compute net winnings and make TDS for each platform separately

- Transfers between wallets of the same operator will be considered as withdrawals or deposits, depending on the deductor’s chosen approach mentioned in point 3.

- Transfers from one wallet to another wallet of a different operator will be considered as withdrawals.

- Non-withdrawable incentives or bonuses will not be considered for the calculation of net winnings. However, upon re-characterization of such incentives or bonuses from non-withdrawable to withdrawable, they will be treated as taxable deposits at the time of re-characterization and will become part of net winnings.

- If an operator provides coupons or vouchers as a withdrawal option, the issuance of these coupons or vouchers will be considered as a withdrawal, and the operator must make the necessary TDS under section 194BA before issuing them.

- In case the prize won in the game is in kind, the operator is responsible for ensuring that tax has been paid on the net winnings before releasing the prize. The operator may request the winner to deposit the required tax to the government as Advance Tax and collect the tax paid receipt.

- For the valuation of winnings in case of prizes in kind, the operator or deductor should consider the purchase price if the prize is bought by them, or the price charged to customers if the prize is manufactured by them. Goods and Services Tax (GST) should not be included in the valuation for the purpose of TDS.

- Relaxation is provided for insignificant withdrawals, subject to three conditions: (a) the amount withdrawn does not exceed Rs 100 in a month, (b) if the amount exceeds Rs 100 in the same or next month or at the end of the financial year, TDS must be made on the amount exceeding Rs 100, and (c) if there is insufficient balance in the user wallet, the deductor or operator must take responsibility for depositing the TDS on the amount exceeding Rs 100.

- Relaxation is granted regarding penal consequences during the period between April 1, 2023, and the date of issuance of Rules 133 guidelines. Operators are expected to fulfill their responsibilities mentioned in the guidelines starting from April 1, 2023. If there are any shortfalls in deductions for April 2023, they may be deposited by June 7, 2023, without incurring any penal consequences.